social security tax netherlands

Tax credits reduce the taxable income in the order of the boxes. Netherlands Non-Residents Income Tax Tables in 2022.

Payroll Tax Netherlands Safeguard Global

The Dutch social security contribution is levied together with income tax.

. The tax rates and tax credits pursuant to the proposals in the 2022 Tax Plan reveal the rate of the first bracket would be reduced by 003. But because it funds so many beneficial social programs the Dutch dont seem to mind. It was established to limit the.

Income from work and ones own home box 1. The Netherlands has published in the Official Gazette the regulation from the Ministry for Social Affairs and Employment that sets the social security contribution rates for 2021. As of 2019 the reduced rate for prime necessities is increased from 6.

Ingehouden loonheffing or LBPR. The contribution is 2815 percent of your salary but will never exceed about 9400 euros. Dog Tax in the Netherlands An annual hondenbelasting dog tax is charged in most Dutch cities.

Need more from the Netherlands Tax. Dutch social security number rather than your US. Spend 25 or more of your time working in that country.

There are two potential rates that you may pay in 2022. VOLKSVZ for premiums national insurance or premiums. You will pay 3707.

The dog tax is one of the oldest taxes in the country. Social security for cross-border working and entrepreneurship. Premiums social security are calculated in the first bracket.

Income Tax Rates and Thresholds Annual Tax Rate. National insurance schemes that are compulsory for everyone who works or lives permanently in the Netherlands. There are three VAT rates.

Just a few simple steps to calculate your salary after tax in the Netherlands with detailed income tax calculations. Social Security Tax For 2021 the Dutch social insurance tax rate is 2765 with a maximum contribution cap of 9713 ie. Changes to the work-related costs rules.

In 2022 the low-income tax rate starts at 23 and goes up to 52 for high earners. Employers may provide such items tax free only if their total value is less than 15 of salary costs. The total state social security contributions are maintained at 2765 including general old-age social security AOW 1790 surviving dependent spouse social security ANW.

Each box has their own rate. The work-related costs scheme allows employers to provide some benefits tax free such as travel allowances study costs lunches and Christmas hampers. There are 2 types of social insurance schemes in the Netherlands.

The Dutch tax system has divided taxable income into three categories. No social security deduction is. Or provide 25 or more of your services in that county.

If your income is above 69399. And Dutch systems you can establish your exemption from one of the taxes. If your income is below 69399.

21 9 and 0. The Dutch residency status is determined by facts and circumstances. Receive at least 25 of your income.

Tax partner or fiscal partner. The 30 rule means that 30 of your salary is considered as exempt from income tax and social security etc. Holiday allowance vakantiegeld Employees in the Netherlands accrue entitlements to holiday allowance.

The Dutch holiday allowance is a lump sum that accounts for at least 8 of the employees gross salary. You will pay 3707 on the income up to 69399 and 4950 on the income in the excess of 69399. If due to remote working the salary becomes partially taxable in a different country than the Netherlands the 30-ruling benefit will self-evidently be lower or nil depending on the specific circumstances.

Income tax includes wage tax and social premiums. Protective assessment in the case of emigration. Income from savings and investments box 3.

Certificates for self-employed people If you are self-employed and would normally have to pay social security taxes to both the US. In principle every Dutch tax resident is liable to pay social security contributions on their earned income. If you reside in the United States write to the.

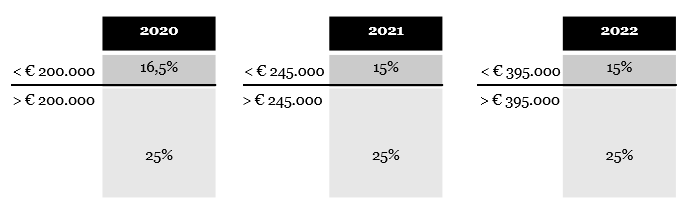

VOLKSVZ where LB stands for wage tax and PR. The top rate of 4950 applying in 2021 would remain unchanged in 2022. In the Netherlands this is the Sociale Verzekeringsbank SVB.

Dutch tax system. Employee insurance schemes that are mandatory for every employee. Your national insurance when you emigrate.

It is therefore very important to take note of this as it can affect your disposable income. Other payroll tax-related changes announced in the 2022 Tax Plan package concern. Wage tax is a tax the employer deducts from the employees salary and transfers to the Dutch Tax Administration and Customs Belastingdienst hereafter Tax Office.

The rate in Box 1 is a combination of tax and premiums social security. On your payslip or year end statement you may see something like. This is just pure salary and is the amount your payroll tax and social security contribution costs are based on.

As the employer the university also withholds pension premiums which are transferred to the pension fund. If their total value exceeds 15 the employer must pay 80 tax on the excess. You must report to the organisation responsible for implementing social security.

If these rates are likely to put you out on the streets dont panic just yet. Income from substantial interest box 2. Income tax in the Netherlands is the highest in the world.

Value-added tax VAT known in Dutch as Omzetbelasting or BTW is payable on sales of goods and on services rendered in the Netherlands as well as on the importation of goods and on the intra-European acquisition of goods. You are insured in your country of residence if you. As this 30 is in simple terms considered as job related expenses.

Wage tax or income tax is a progressive system in the Netherlands. Note that when you are covered in the Netherlands you will no longer be covered by your own countrys.

How To Read And Understand Your Dutch Payslip Dutchreview

Social Security In The Netherlands Zorgverzekering Informatie Centrum

Tax Revenue Statistics Statistics Explained

Dentons Global Tax Guide To Doing Business In The Netherlands

Payroll Tax Netherlands Safeguard Global

How To Read And Understand Your Dutch Payslip Dutchreview

Netherlands Economy Britannica

Payroll Tax Netherlands Safeguard Global

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Us Expat Taxes For Americans Living In The Netherlands

France Tax Income Taxes In France Tax Foundation

Netherlands Social Security Rate For Companies 2022 Data 2023 Forecast

Self Employment Social Security Taxes For Expats H R Block

Belgium Luxembourg Netherlands Personal Income Tax Rates 2021 Statista

Netherlands Economy Britannica

France Tax Income Taxes In France Tax Foundation

Dutch 2021 Tax Bill And Real Estate In The Netherlands Insights Greenberg Traurig Llp